nj 529 contributions tax deductible

Some state 529 plans allow contributions to the plan to be deductible for in-state residents. Ad 100 of your tax-deductible donation goes directly to your chosen recipient.

Can I Use A 529 Plan For K 12 Expenses Edchoice

NJBest does offer a tax-free scholarship for New Jersey students who attend school in the state with a maximum of 1500.

. But of course when choosing a 529 Plan when your child is young. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct. Of course your total amount in the plan can be higher as.

On the downside neither plan allows account holders to make any tax-deductible contributions which is rare among plans sponsored by states that levy an income tax. Nj 529 contributions tax deductible. 36 rows Nebraska offers married taxpayers a state tax deduction for 529 plan contributions to a 529 plan of up to 10000 per year Ohio offers married taxpayers a state tax.

Contributions to a New Jersey Better Educational Savings Trust NJBEST You can deduct up to 10000 of contributions made during the year into an NJBEST account. Starting in 2022 New Jersey will offer a state tax deduction of up to 10000 per taxpayer per year for contributions to a New Jersey 529 plan. Because New Jersey law incorporates the provisions of IRC section 529 New Jersey follows the federal expansion and considers a withdrawal from an IRC section 529.

But if you live in New York and pay New. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for. Ad 100 of your tax-deductible donation goes directly to your chosen recipient.

The benefit would only. As of january 2019 there are no tax deduction benefits when making a contribution to a 529 plan in new jersey however you do have the ability to take. Contributions to such plans are not deductible but the money grows tax-free while it.

As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of up to a 1500 maximum. 1518 Reply 1 Best answer LindaA Level 10 June 4 2019 1214 PM New Jersey does not offer a deduction for 529 plan contributions. Your contribution cannot be more than 75 of your annual health plan deductible 65 if you have a.

Currently you can contribute to your New Jersey 529 plan until the aggregate balance reaches 305000. New Jersey offers two 529 college. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes.

The budget deal creates new tax deductions for contributions of up to 10000 into an NJ Better Education Savings Trust 529 account for households earning up to 200000. New Jersey follows the federal rules for deducting qualified Archer MSA contributions. New Jerseys plans do not give that advantage.

The proposal includes a provision to allow New Jersey taxpayers to deduct 529 plan contributions of up to 10000 per year from state taxable income. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan. Beginning with the 2022 Tax Year the law will allow New Jersey taxpayers to deduct 529 plan contributions of up to 10000 per year from state taxable.

College savings plans fall under Internal Revenue Code Section 529 Qualified Tuition Programs. State Tax Deduction New Jersey taxpayers with gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per. Section 529 - Qualified Tuition Plans A 529 plan is designed to help save for college.

Unlike many states the IRS does not provide a current tax deduction for. You must have a gross income of 200000. 529 Plan Tax Deduction.

The Federal Tax Cuts and Jobs Act TCJA which was signed into law in December 2017 and became effective January 1 2018 expanded the definition of a qualified higher education.

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

529 Plan Deductions And Credits By State Julie Jason

529 Plan State Tax Deduction Limits And How To Choose A 529 Plan And Save Now For Future College Costs Prepaid Vs College Tax Savings Plan Aving To Invest

How Much Can You Contribute To A 529 Plan In 2022

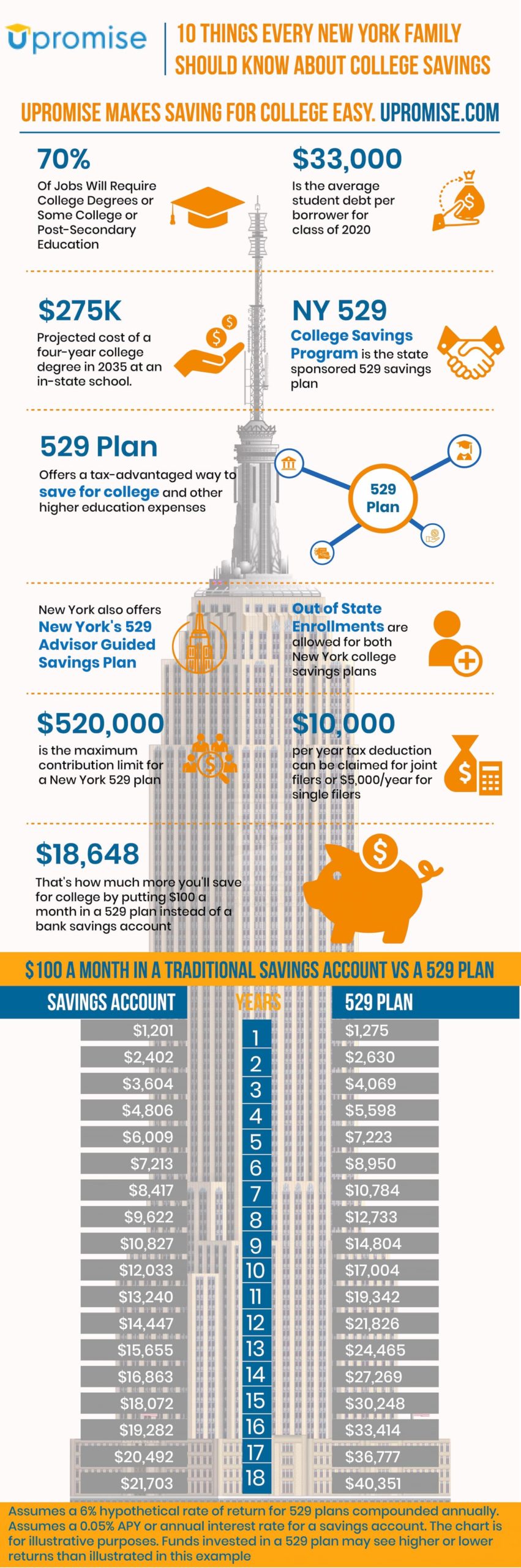

529 Plan New York Infographic 10 Facts About Ny S 529 To Know

An Alternative To 529 Plan Superfunding

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

States That Offer 529 Plan Tax Deductions Bankrate

Where Do I Enter Contributions To A 529 Plan For T

How Do I Write Off 529 Plan Contributions On My Taxes Sootchy

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

529 Plan Tax Deductions Are Offered By 34 States Here S The List For 2021 Along With States That Give Breaks For Each Other S Plans Business Insider India

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Information On 529 Plans Turbotax Tax Tips Videos